fareastwarriors

Member-

Posts

5,506 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by fareastwarriors

-

Are standard retail leases that long though? I thought they are 5 five years usually. In my example, the SMALL building has been completely vacant since 2015. I know it's hell to get anything entitled in the Bay but still. The MEDIUM building did finally take on a new Pizza tenant last year (finally). That building will have donuts and pizza (soon). :) It seems like they want to rent space out. Lastly, I would love to see some new development for senior/student or any just housing. We need it. Any new development (residential or retail) would be an upgrade compared to the dated strip malls, fast food places, and vast surface parking lots we have now.

-

Didn't want to start a new Thread. Can someone share some insights on why some commercial properties sit vacant for So long? Here's the background. I live near a busy Main street in the suburbs of Oakland (San Francisco Bay Area). When I moved there in 2014, houses were going for high 300 - low 400k. The people were mostly working class like factory workers and restaurant types. Now the houses are going for low 700k. There has been turnover and I see more office professionals move in but it's mostly higher pay blue collar types like self-employed construction. There are 3 strip malls on the same street couple of blocks away from each other. These are not fancy or new, just rectangle boxes with parking out front. Two blocks away in the opposite direction, there is a Target anchored retail property that is basically fully occupied. LARGE has maybe 20 spaces available for rent. It was half empty in 2014. MEDIUM has 5 spaces available for rent. It had 1 tenant in 2014. SMALL has 4 spaces available for rent. It had 1 tenant in 2014. Now more than 6 years later: LARGE is nearly full with only 2 spaces available. MEDIUM now has 2 tenants (The new/2nd tenant is not even opened yet. It's going to be a pizza joint from a tiny local chain). SMALL has 0 tenants. LARGE, MEDIUM and SMALL still have (faded) FOR LEASE signs from different companies up. I don't think SMALL and MEDIUM buildings are going for redevelopment since there are no signs and I didn't receive any letters from city to comment on potential development. Besides there plenty of surface parking lots available for redevelopment if investors were interested. LARGE looks the oldest and don't have any national brands besides an Autozone and MetroPCS store... The Autozone predated me. Everything else is just mom-and-pop shops like restaurants, ice cream shop, and hair/nail salons. These are not even Instagramy hipster places but just small places selling pho, pupusas, HK-style bbq meats, and etc. The area is booming with higher income people moving in. LARGE's parking lot is always full now. So what is the deal MEDIUM and SMALL? Why are their spaces still vacant all these years? I see this around town and also in other cities. Yes, I get some locations are just weaker or there is too much space available nearby. Still, why are so many places vacant or seemingly underutilized even in the highly populated and/or growing areas? Sure some are institutionally owned and the REITS maybe have other stronger properties so they afford to wait for the high rent/right tenant. But what about those smaller ones? All those owners can afford not to rent for half decade, if not more? Am I missing something?

-

Debt is 2 way street. If your financial house is in order, I'm for taking Some low rate debt to invest in higher returning assets. I employ margin in my taxable investment account and tap my HELOC all the time for Real estate and stocks. I'm not so sure about crypto though. I have little chance of being margin called and I have other assets on hand (with varying levels of liquidity) to cover unexpected issues. Different for everyone.

-

I am also directly short tesla, but it is just a 2% position of my portfolio For a "value investor" community, I think being LONG Tesla is More crazy.

-

A bit of BAC. Why not.

-

Visa moves to allow payment settlements using cryptocurrency [url=https://www.reuters.com/article/crypto-currency-visa/exclusive-visa-moves-to-allow-payment-settlements-using-cryptocurrency-idUSL4N2LR2U2]https://www.reuters.com/article/crypto-currency-visa/exclusive-visa-moves-to-allow-payment-settlements-using-cryptocurrency-idUSL4N2LR2U2[/url]

-

Sold some MX. Paid down some margin. Started GILT. sold remainder MX. Go private at $29. $26 is good enough for me. How many stocks are you holding Greg? Seems like you have a bit in everything and baskets of SPACs and REITs.

-

Y'all back at it again like in the Coronavirus thread? Don't you guys get tired? I'm just here for the free donuts.

-

The picture you attached to your post made my laugh like hell. Nice lid :-) If you think that's funny, you should see what it looks like now. :P I been loving the memes/tweets from @ParikPatelCFA on Twitter.

-

Dogecoin anyone?

-

Robinhood aims to allow users to buy into IPOs https://www.reuters.com/article/us-robinhood-ipo-distribution-exclusive/exclusive-robinhood-aims-to-allow-users-to-buy-into-ipos-sources-idUSKBN2BH36G

-

I added a bit to Sea today.

-

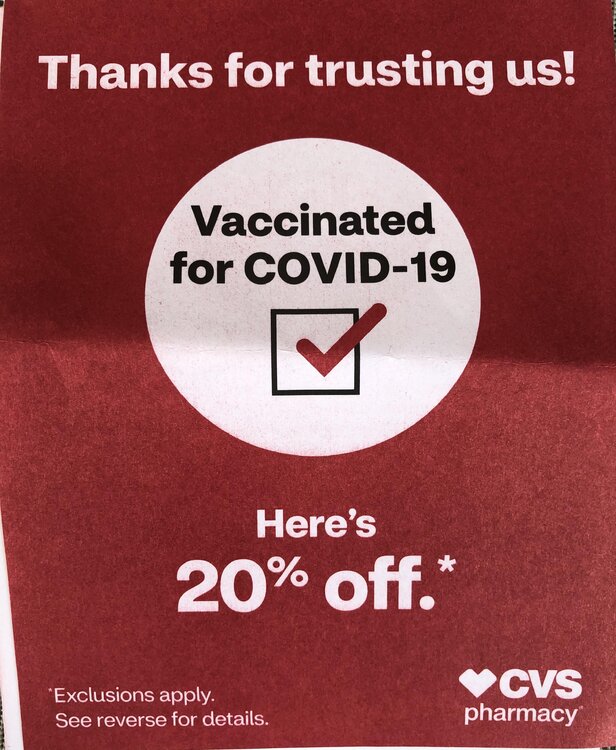

Got my first Pfizer shot at cvs. The wait today was bad. Over 45m Need to get my donut All I got this

-

Do it for the freebies! lol https://www.cnbc.com/2021/03/23/here-are-a-few-of-the-freebies-for-getting-the-covid-vaccine-.html

-

Let me join the party. A bit of BABA

-

APTS and BRK.B .

-

I snagged an appointment for a Pfizer shot later today at cvs

-

Why get inoculated for polio or hepatitis? Because the cost/benefit ratio is extraordinary. This can get ugly fast so let's not make quick judgement. Hopefully he makes an informed decision and that's it. It still his decision.

-

Yes, the appointment systems here in California is shit too. Zero luck with the state run site... Walgreens and Albertsons rarely ever have available appointments. CVS does a good job and I been snagging a bunch of appointments for my relatives.

-

F*cking hilarious. The reversal of the ticket in the reverse card, and shaking the 8-ball 4 times to get the answer he wanted, is amazing! I know he's having fun with this, but I also have to wonder if this is what he did with GME Lol. Maybe I should replace my screener.co subscription with my kids banagrams. Many money managers are not beating their indices anyways. Random walk down wall street!

-

Goldman Sachs Seeks Volunteers for Move to West Palm Beach Digs A couple hundred people might go, and more could follow later Top executive Stephanie Cohen plans a second office in Dallas https://www.bloomberg.com/news/articles/2021-03-18/goldman-sachs-drafts-volunteers-for-move-to-west-palm-beach-digs

-

Yup. But as employee, they were a very solid employer with high pay, great benefits, and a pretty good culture. The only reason I left was so I can focus on real estate. Now I don't have to pre-clear and wait for compliance to approve my trades. :) Buy, buy, buy! TBF, our funds average expense ratio of 0.40-0.60% were good deals in the active mutual fund community. The funds turnover were low at about 20-30%. If you're an institution or pension and you want decent returns and not high beta, our funds would be solid choices. I CANNOT stand all those companies/people peddling sucky 1%+ expense funds with all kinds of sale charges. It's criminal how much people pay for shit performance.

-

I worked at an active mutual fund company and most of our funds underperformed their indices for 10-15 years... Yet we worked in a nice downtown office and everyone earned fat paychecks. All those those fancy MBA's and PhD's from Harvard, UPenn, and Stanford and CFA designations didn't help...We preached all the value principles and emphasized long term time horizon but at the end of the day, we didn't perform. SMH

-

Bought some CURI as well. LC can I ask whether you truly believe the ancillary businesses add value for the next 2-3 years, I was seeing it as a pure "Non-Fiction Netflix"/content creator, as far as I can tell they havent actually signed anyone up for the "sponsorship" business yet. Also picked up some Reliance and Infosys (ADRs). Surprised that all the EM "hype" hasnt led to stronger demand in Indian bluechips, but expecting it to come at some point. And market is significantly undervaluing the Jio platform and the ability of Mukesh Ambani to extract every once of value out of the Indian consumer base. What ticker are you buying for Reliance Industries ADR?