thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

At first glance, I think this is a nice idea. Just to confirm your 7% cap rate math, is it something like this 1.2 billion debt 0.98 billion equity 2.188B EV Existing Income Portfolio NOI = 122 million 122 / 2188 = 5.4%cap rate using only existing estate w/ corp overhead of 14mm/year 108 / 2188 = 4.9% cap rate w/ corp overhead. but there's a 394mm development pipeline that's 80% pre-let which is non-income producing. Given the degree to which this is pre-let, we may assume that they'll at least generate their cost on this investment, so if we back that out from the EV 2188-394 = 1794, which gives you a 6.0%-6.8% cap rate (depending on whether you count overhead). Alternatively, if you assume they'll make a 6.0% yield on cost on the development, that will get you into a mid-high 6% cap rate as the development NOI comes in line over the next 3 years. So you're buying a portfolio of 93% occupied 7-8 year weighted average lease office in mostly Brussels and Flanders at a 5-7 cap (depending on what you want to count/not count). The debt cost 2% and is 90%+ fixed rate so you have close to an 8.5% yield to the equity, much of which is returned to you in the form of the 7% dividend. On the risk side, leverage is reasonable at 40% of management asset value and 55% of the mtm enterprise value. this is in a NIRP environment. seems pretty reasonable to me. The belgian 10 year yields -0.36% and the 2 year yields -0.7%, so there's negative hedging costs (though I probably wouldn't hedge since I don't have a lot of euro exposure and would just take on the currency risk.

-

if you really want to go crazy all the HK property stocks are "cheap", though my only exposure is ownership of Hong Kong Land at an effective NAV multiple of like 0.2x via Jardine Strategic. I'm sure all the other HK landlords are just as cheap (CK Asset may actually be interesting given it has very low leverage and owns things like british pubs and aircraft leasing and infrastructure so not just ?HK property, not reaaaaly my bag though). the two Superman stocks (1 HK and CK Asset) are like a hodge podge of everything hated in the world: mainland china, hong kong, UK, real estate, energy, infrastructure (not hated as much), etc. Mitsubishi Estates owns the best CBD real estate in the world in my opinion (Maranouchi District, near the palace in Tokyo http://marunouchi.mec.co.jp/en/photo/), but it's a giant Japanese company w/ all that implies. With dividends reinvested, it has returned -0.7% since 1988 :o

-

see slide 38, Paris CBD is marked at 3.1% cap rate and Paris Resi 3.2%. I'm not saying that's "wrong" given where rates/vacancy/whatever is, just saying that when you're buying 30% LTV 3 cap stuff at 70% of NAV, you're paying a 4 cap. One thing to be mindful of is lease structures vary across countries so all cap rates/ NOI’s are not equal. British office leases, I believe, put more of the cost burden on the tenant, and kind of resemble NNN leases. HK leases whenever I’ve looked seem much shorter and HK buildings have the steamiest cap rates in their NAVs. I haven’t dug into French/Gecina. The NYC model is mostly “modified gross” where certain costs are passed through to tenant.m, but you have some gems like ALX Bloomberg tower where more like NNN. ARE and BXP have a fair bit of pretty long duration NNN like structures, one of the reasons ARE trades so dear. https://www.gecina.fr/sites/default/files/2020-07/gecina_-_earnings_at_june_30_2020_-_presentation.pdf

-

Gecina uses <4 caps for its NAV(IFRS so book = mgt NAV, kind of), at least when i looked at it briefly. While this may be the market for Paris office and apartments, when you have low leverage and extremely low cap rates, a 30% NAV discount isn’t necessarily exciting. Its EV is down 13% sinc e 12/2019 and most leverage is corporate level IIRC (that should be fact checked), whereas in contrast something like VNO’s EV is down 30%, has mostly secured/non recourse debt, and started the year at a bigger NAV discount (though NAV has fallen more) I’m not dismissing the idea. I spent <1hour on it 6+ months ago.

-

I don't think that is necessarily true. I think what you are seeing is rebalancing between funds and OTC put assignment. he got more shares put to him. he now owns 25% of the company, all in simple long stock form (no options/swaps). “On January 6, 2021, the Reporting Persons restructured and rebalanced its investment in the Issuer,” according to the filing On January 6, Pershing acquired shares via the obligation to purchase common shares pursuant to previously written and reported put options which expired on Jan. 6, the unwind of 3.5 million previously written and reported put options expiring in 2021, and the purchase of shares of common ctock, according to an amended 13D filing The previous 13D/A filed on June 5, 2020 showing Pershing’s 19.9% stock ownership also referenced 32.5% beneficial ownership, an amount reflecting a case where all put options were exercised

-

The above setup describes EQR and ESS though ESS is exclusively west coast and EQR is west coast plus NY heavy. If you take the 30% down and replace it with 10% and insert sunbelt/southeast for geography, then you are describing MAA and CPT. Given that multi family is more uniform and fungible than say malls or office (which are extremely asset specific), I think a basket approach makes sense as long as you trust mgt and want to own in the various geographies. There are obviously differences but the general set up for all of the blue chips is kind of the same. Or you can go smaller/ more levered / family controlled with NEN/ CLPR. I sold my NEN at a 30 % loss in the throes of covid and bought the blue chips and haven’t looked back. Dabbled with CLPR.

-

Wife gets Pfizer vaccine on Monday (DC hospital, government affiliation, risky patient facing but not “front line” as in ER / ICU / covid unit) Sister got Moderna vaccine today (South Florida hospital, large hospital system, risky patient facing but not "front line" ) All the staff at my grandpa’s long term care facility have been vaccinated but I don’t think he has (he’s 94) Dad vaccinated today. He is 68 and has an autoimmune disease that makes him high risk, but that’s not why he’s getting the vaccine. He’s getting it because my sister is an employee of the hospital and the hospital is enacting a program where employees can bring in a 65+ year old of their choosing. The roll out is so weird. Mom vaccinated today because of sister's hospital employement (sister just called and asked if she could bring her in). Grandpa vaccinated today because he's 94. Wife 2nd dose today because she works in a hospital. After today, I am the last remaining in my immediate family to have not been vaccinated at least once. Just an anecdote about the vaccine rollout is. It seems pretty consistent across my friends/family that if you have work at a hospital or long term care facility or know someone who does, you're getting vaccinated or have a date (my cousin is a nurse practitioner in Tennessee at a hospital and just got hers too, my hygienist aunt in Tennessee has not gotten it yet).

-

yea, I think i understand the general rules regarding exclusive benefit/fiduciary duty as well as the general concepts of self dealing. I am just surprised there isn't an exception for money management at market terms. There very well may be. The way I interpret it, If I wanted to manage my own IRA or my immediate family's IRA for a reasonable fee such as pass through expenses + 0.5% or 1.0%, that would be a prohibited transaction and force the accounts to cease to be IRA's. There's got to be someone out there who has dealt with this? or do all the small managers here invest their IRA's separate from the funds they manage This seems pretty clear that it’s a no no https://www.richeymay.com/wp-content/uploads/2016/11/Considerations-for-IRA-Investment-into-Fund-Structures.pdf Can I invest my IRA in my own fund? A. Yes, as long as your IRA investment does not provide benefit to you personally. For example, avoiding personal benefit would include that you do not charge fees for managing the funds, do not own 50% of the fund, either personally or combined with other disqualified persons, do not use your IRA to draw in other investors, or your fund is self-sustaining without your IRA investment. Q. Can I charge fees to my family members? A. It depends on whether or not they are disqualified persons. Typically, lineal ancestors or descendants are not allowed; certain lineal ancestors or descendants of the spouse may not be allowed and other family members (i.e. cousins, brother/sister) are likely okay. For specific questions on which family members are or are not allowed, please consult tax counsel. Q. Is there a limit on the amount of retirement funds I can allow in my fund? A. Depending on the circumstances, if any class of interests in an investment entity is funded by 25% or more of retirement assets, there could be a trigger of fiduciary and prohibited transaction rules. Consult with your tax counsel or other professional familiar with these rules.

-

Yes, Reits are best in tax deferred accounts. Lots of good suggestions in this thread. Under current law REITs are pretty tax efficient in a taxable account as well, but I wouldn’t assume the 20% deduction lasts too long. https://www.reit.com/investing/investing-reits/taxes-reit-investment

-

I invest my own money as well as that of my parents and sister. I do not take compensation other than (hopefully) making my family wealthier. About 60% of my investment assets are in IRA's/HSA, and about 30% for my parents/sister. Occasionally, I contemplate forming a partnership (in 5-10 years once certain goals are met). Let's set aside whether or not this is a good idea for the purposes of this thread and details about set up (SMA's, Onshore, offshore, etc). My question is: does anyone manage immediate family member's and/or their own IRA's in exchange for compensation? Or for free The basis of my question is that most of what I find on the internet tells me that if there is any benefit accruing to you from your own or your family members' IRA it's a prohibited transaction. This could even include a "marketing benefit" such as "I have all my and my family's money (including) IRA in the fund so I'm well aligned" or pass through expenses such as audit and admin. I recognize this is firmly in the "consult a lawyer" camp, but I'm wondering if anyone has dealt with this. Let's say hypothetically, I'd want day one GP investment to be $xx and initial AUM to to be Y. Whether I can use IRA money has a significant effect on that.

-

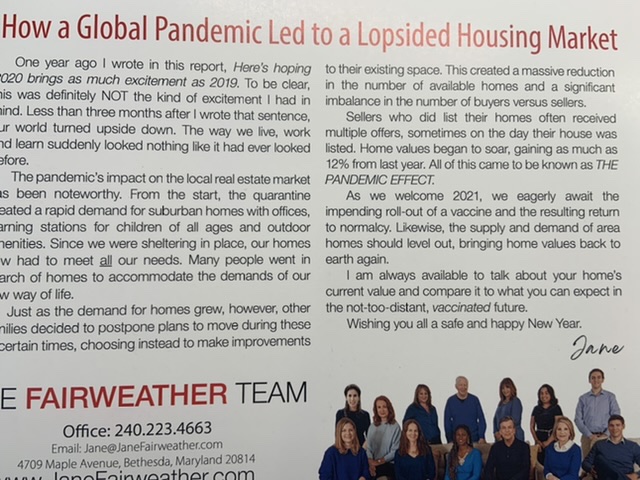

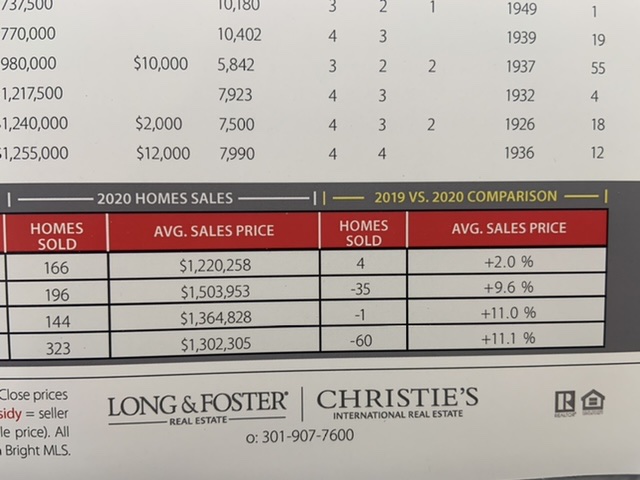

Suburban DC Maryland data; price up 10%-11% for the zip codes with only SFH, collapse in transactions. Note the hopeful tone from realtor that prices will “come back down to earth” easy to understand why this actually hurts realtors as they get paid on transactions. Not taking my 10% to the bank, but happy to own some expensive ass dirt with eroding tiny structure on top for well below the average dirt+house cost of $1.5mm

-

FMBL trades 0.77x book, 11-12x earnings, and has 2x+ the amount of capital to be well capitalized, and has close to $10B $8B of deposits across just 25 branches, 40 ish % of which are non interest bearing. The attraction of FMBL is a function of how much one values safety and over capitalization of that excess capital will never be returned to you. I value it because even if never returned it makes the earnings stream safer. Staying with the theme of illiquid overcapitalized SoCal family go’s, LAACZ seems reasonable to me. Whether you think PMV is $3K/share or $4K plus, $2500/ share = 4% yield growing at mid single digits with an option on some kind of change. Even hair cutting Apple, Berkshire continues to be very reasonable priced. In a world where SPACs trade at 20% premium, EQC at 93-100 cents of NAV offers reasonably priced optionality. BSM and DMLP offer close to 10% yields with direct exposure to hydrocarbon price/volume with low to no leverage. Can still be bad investments though if production collapses. I actually think GOOG and FB, even MSFT are not unreasonably priced. Not cheap, certainly some tax and regulatory risk, but, not crazy to me. Multi family REITs (including non urban) are at 5 caps and can borrow at 1-3% and have low leverage. What I don’t understand about the 50%+ cash crowd is I think there are plenty of securities out there that are highly likely to preserve amd grow purchasing power over time out there. I don’t think any of the above will CAGR at 15% for the next 10 years, but I’d be surprised at less than say 6% (unless say EQC doesn’t find a deal).

-

the barbarous relic

-

me (seeing my large position in PSTH covered calls go from $20.5 to $23.5): is this what being a growth/SPAC guy feels like? guy (loaded on TSLA and crypto) up a gazzilion percent: no, this is definitely not what it feels like.

-

Wife gets Pfizer vaccine on Monday (DC hospital, government affiliation, risky patient facing but not “front line” as in ER / ICU / covid unit) Sister got Moderna vaccine today (South Florida hospital, large hospital system, risky patient facing but not "front line" ) All the staff at my grandpa’s long term care facility have been vaccinated but I don’t think he has (he’s 94) Dad vaccinated today. He is 68 and has an autoimmune disease that makes him high risk, but that’s not why he’s getting the vaccine. He’s getting it because my sister is an employee of the hospital and the hospital is enacting a program where employees can bring in a 65+ year old of their choosing. The roll out is so weird.

-

About -10%. about 90% market exposure. (I don’t consider 7% in EQC or 15% in PSTH covered calls to be market exposure). This excludes some hedges/puts.

-

Russell 3000 Value +3.1% Russell 3000 Growth +0.25% Yes.

-

Wife gets Pfizer vaccine on Monday (DC hospital, government affiliation, risky patient facing but not “front line” as in ER / ICU / covid unit) Sister got Moderna vaccine today (South Florida hospital, large hospital system, risky patient facing but not "front line" ) All the staff at my grandpa’s long term care facility have been vaccinated but I don’t think he has (he’s 94)

-

COBF 2020 Returns (pre-tax, after fees, etc)

thepupil replied to Broeb22's topic in General Discussion

2020 My IBKR consolidated accounts show a return of -4%. These comprise about 60% of assets. My ~35% in fidelity accounts performed better, as did the 5% in my wife's Roth IRA which was in VTSAX (ha!). It's difficult to tell their actual performance because of inflows due to rollovers. If I add up all the dollar profits from non IB accounts its about 4% of my ending NW and 2x the IBKR $ losses, so I think overall return is bout 2% My NW grew about 30% from savings, mortgage amortization, and home price appreciation, which is a consolation prize in a humbling year. Here's to being very levered long SFH and having a good year professionally! (though 10% HPA is not sustainable and will reverse at some point) I endured a ~40%+ drawdown in the beginning of the year as I went into this very poorly positioned with heavy financials and office exposure. Several of my holdings have not recovered though in my opinion value grew (Berkshire/Tetragon); while others have endured permanent impairment (office). While I recovered, I think that initial drawdown did impact my overall ability to recover more strongly. I'm a bit more timid these days. My biggest mistakes were in portfolio management. I manage my parents/sister's money and they each outperformed their net exposure (albeit slightly) w/ far lower weighting to tech stocks than the broader market. My own portfolio suffered from undue concentration and premature doubling down in the initial February / March timeline and theirs did not as I run theirs with a greater diversity of idea types and w/ a greater tilt toward business quality. I can handle missing out on the triple digit gains of the most growthy/tech-y crowd (I know how I'm wired and why I'll never be good at that), but there's no way around it: I completely failed to take advantage of what was one of the better opportunity sets of my short investing career. May write more detailed analysis of what went wrong at another time. John, I'm terribly sorry about your brother. -

My largest position is PSTH covered call. Long PSTH, short December 40 call, bought for $20.50, it’s at $21.30 now. Think it will be hard to lose more than 10%-15%, with upside of close to 100% if market gets very excited about a deal. I don’t know if it’s my favorite idea, but it’s my biggest. And I always have to show love for Tetragon. This year is the year lol.

-

Berkshire is so delightfully reasonably priced and safe. What’s wrong is that I can’t find 10 such ideas of equal quality and safety and resign to slumming it with crappy real estate co’s and holdco’s.

-

Wife gets Pfizer vaccine on Monday (DC hospital, government affiliation, risky patient facing but not “front line” as in ER / ICU / covid unit)

-

Good point, I made about 40% on AIV and EQR is up about 36% over that time, could’ve just stuck to the good stuff. I’m with you in hoping for some AIV destruction!

-

Don’t get me wrong, I went from 25–>45 bps in AIV today (getting crazy!) and understand why people are buying it, but think that it was much more interesting to buy the package in the low to mid $30’s at 60% of NAV including the apt portfolio, than CrapCo/RemainCo is right now at 55% of company NAV. Think my fellow AIV holders have a long and tough road ahead of them.

-

I don't recall Buffett ever buying gold the commodity (Berkshire (probably not buffett) did buy GOLD (Barrick Gold) recently) Are you thinking of this? He made a little in silver back in the day. https://www.gurufocus.com/news/906807/warren-buffetts-giant-silver-trade-