thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

this is a long winded way of saying, I have no clue why its selling off so much

-

the long end is just not that liquid. I remember reading in the early days of QE that at one point the Fed ownd like 70-80% of the 20-30 year coupon interest because they prioritized higher coupon legacy bonds. I don't have an updated statistic on this but conceptually I think of long end as having small "float" to use equity metaphor. which is why i think there's talk of ensuring orderly trading through buybacks despite overall stance of tightening. I think it's awesome...getting high quality long duration at levels like this means long duration bonds are real diversifiers for first time in a while...buy a bond...goes down 5 points, buy some more goes down 5 points...buy some more goes down 5 points...i mean this is glorious. the goldman muni bonds i posted yesterdaya t $105 just traded at $98 and are at 9%+ tax equivalent yield...prepare for more pain and some folks to blow up...don't spend it all at once...

-

531127AC2 - Liberty NY Dev Corprev Goldman HQ 05.25% 10/01/2035

thepupil replied to thepupil's topic in General Discussion

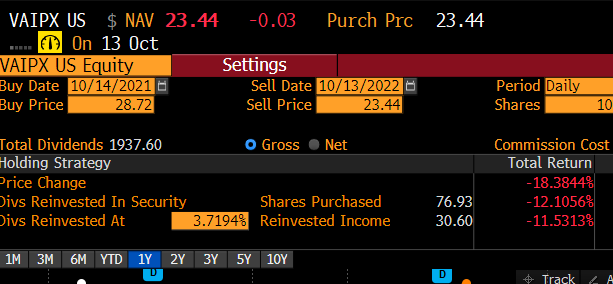

also, because i got curious, this is the 3rd time I've bought this bond with other times having sold out for a nice gain. last time I bought/sold it in 2020/21 for a relatively tax efficient 20% gain. Over my hold period the S&P 500 returned 73%. so you should probably just buy the stock market. -

531127AC2 - Liberty NY Dev Corprev Goldman HQ 05.25% 10/01/2035

thepupil replied to thepupil's topic in General Discussion

I bought some of the goldman bonds for my parents today for $105.6 / 4.67% tax free. that's a tax equivalent yield of 7-8% to lend to goldman sachs / their HQ building. bonds down about 45 points from peak and at about where they were during the crisis of early 2020. -

Kimco 4 1/8% of 2046 at $70.5 / 6.6% +250 $7.5B of debt / $18B EV. LTV = ~40% on market. because buying debt at 70 cents, last dollar is at like 30% LTV. KIM has very long duration fixed debt and owns a bunch of grocery anchored strip centers that i think will be fine over the long term. my current yield of 5.9% is a decent carry and a get a fair bit of convexity/punch if long rates go down. I bought a HUGE 90 basis point position in these today. Fortune favors the bold.

-

Which activities in life brings you the most fun?

thepupil replied to Charlie's topic in General Discussion

Just be careful with endpoint sensitivity! My IBKR account October 2013 - October 2020: +42% vs +123% SPY -80% underperformance November 2020 - Present: +113% vs +12% SPY +100% outperformance Inception: +209% vs + +160% SPY I present my slightly positive pre-tax, probably negative post tax alpha of my IBKR accounts (though >1/2 this non taxable) not as a brag or in a self deprecating way, but as a data point that trailing performance is (sometimes) not predictive of future returns. Until proven otherwise, i put myself in the "should probably index but we'll see" camp. -

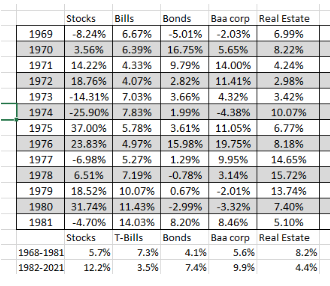

I have been (somewhat aggressively) bonds this year and am planning on continuing to do so. some thoughts - 2% real shouldn't be dismissed. 2% real would basically guarantee me and my family a wonderful life. If I work for 10-20 more years, save what i'm saving and made 2% real on my investments, I'll accomplish pretty much everything with respect to wealth generation and be able to provide inheritors a decent sum (assuming nothing wild and crazy wrt tail risks thereafter). I have to date made low teens per annum on my money over course of a decade or so ( not too far ahead of various markets) and plan on making >2% real on the totality of my capital, but 2% real is not some disaster. - no one (prudent) is investing 100% of their money in bonds. if you put 20% in bonds and have 80% in risk assets, it doesn't really cause that big of a drag on return. most historical studies actually show HIGHER returns for portfolios w/ 10-15% ish bonds vs 0% bonds because of the rebalancing/diversification effect. I don't fully ascribe to modern portfolio theory by any means, but there is SOMETHING to be said for diversification. I think that was far less true where rates were 1 year ago vs today. rates have moved substantially and may provide a source of diversification going forward. I'm still 90% long equities (and 15% ish long bonds) - deflation hedge: risk assets love relative price stability / predictable environment. they do not love lots of inflation and i'd view deflation as the scariest of all macro scenarios, particularly for levered real estate (which i invest a good bit in). very high quality, long term bonds are the best deflation hedge out there. -it's not just the yield, there's lots of opportunity for price appreciation. let's take the BNSF 2097's at $120 / 6%. While i certainly am not predicting it get back there, this bond was $230 within the past 2 years. I think it's a mistake to say "why would i invest in that to make 6%?". I would say that with a long time horizon 6% is the minimum return and there's a big option on yields going down and making a bunch of money on a shorter term time horizon (competitive with the upside of stocks). I feel like everyone focuses only on price downside of bonds. Duration is both risk and opportunity. if at any point within the next 5 or 10 years these trade at 5% yield, then one will make the current yield of 6% + 20% of capital appreciation which would add 180-370 bps of return (7.8-9.7% /yr of total return). trading to a 4% yield would add 48% of capital appreciation (4-8% on a10 and 5 yr time horizon which would be total return of 10-14% / yr of total return). there are headlines talking about inflation going down to 3% in a few months. I don't know if that will happen, but it may happen within the next 5 years. could the bond go down? of course it could, but it's quite easy to hold and just clip coupons. now this isn't "i only buy 5 bagger" type of returns, but your risk profile is pretty different too. you are lending on like 20-30% LTV loan to the country's 2nd largest railroad with a hell of an equity sponsor in Berkshire. -convexity is real. Take our BNSF bond. At 2% lower yields it's +47%. At 2% higher rates its -25%. the positive asymmetry of long duration bonds is beginning to come forth. now if you think inflaiton will be 9% forever and this should yield 10%, you're still going to lose 40%, but I'd say stocks are down 30-60% in that scenario too. on a 5 yr hold basis, you'll make ~30% in coupons and at +-2% on rates be down 25% to up 47%, for total cumulative return of +5% to +77%, call it 0-12% / yr before taking into account reinvestment of the coupons which wuld put that higher. rates can certainly go up or down more so it doesn't cover the whole probability tree, but i think that's decent risk/reward. - mental drag/attention: I focus on high quality IG bonds with lots of diversification. I'f been buying a 1%er in this healthy co, 1% in that, etc. or tsy's/tips. the underwriting is simple "will this pay the interest and principal" "will the EV of this company decline by 60-70-80% such that I'll take a loss"...there's no work with respect to predicting earnings or worrying about really much of anything. bonds senior position has value in its low maintenance requirements. cant get too complacent of course. I would index if there was an index of 20+ year non financial corporate BBB or better bonds...but don't think there is - reinvestment: bond yield to maturites assume one reinvests at the current YTM but that doesn't mean you can't reinvest the coupons in something sexier in the future. - i still consider myself short rates. I'm short about $750K of mortgage which has a duration of about 18 and is at a fixed rate of 2 7/8%. I own < $750K of bonds and total duration of bond portfolio is <18. rates going up still benefits me if I'm going to hold my house/mortgage for its 28.5 yr duration, which i might. my biggest issue with bonds is their tax treatment sucks and i only have limited IRA/401k space. anyways that's my ode to going long bonds. of the high quality long duration variety. go get em fellas.

-

Which activities in life brings you the most fun?

thepupil replied to Charlie's topic in General Discussion

Hanging out with family, hosting/going to friends for dinner (and going out to eat). I’m a simple man at heart, once you peel away the layer of coastal elitism, materialism, and careerist anxiety. -

1. It’s not down 8.5%. The price is down 8.5% but total return is -2.8%. 2. it’s short but not zero duration. Avg maturity/duration is 2.5, let’s just think of it as a 3 yr tip. 3. yes the principal does go up. why it’s down 3% is because real rates have increased, which is precisely the appeal of them going forward. I can’t find it for 2 yr TIP but TIPs yields were -1 to -2% about a year ago. one thing I’m not sure of is of the fact that you’re in the ETF and it’s maintaining a constant maturity of some of those losses were realized, one could own individual TIPs to resolve this

-

once you get to a point where you have decent coupons / reinvestment (tough to say when that is, but certainly getting closer), duration decreases and you don’t lose that much. It all depends on how quickly rates rise of course. rate risk just doesn’t scare me. Bonds have lower duration than stocks. Have gone from like 5% bonds to 15% this year, will look to take credit risk as HY goes past 10% and solid BB’s approach 9%. Bonds are so comfortable to average down in. also because floating rates are up and spreads have widened, you can buy stuff with no duration and safety for 5.5-6.0% floating Join the dark side y’all.

-

you gotta look at the total return of bond funds, not just price. real rates have increased so even realtively low duration will take some losses...iu got confused and thought VTIP was TIPS index which it's not...the Vanguard fund that's the whole tips market is down about 12% over the past year...your principal adjustment in that case is still a far out cash flow and has duration...if you truly can't have any MTM risk, then i-bonds are the only real choice. but to lock in more real return and make money if real / nominal rates decline, you need to take on some duration.

-

1/4 i-bonds at 0% real / (currently 6%-7% yield) 0 duration 0 mark to market risk, no credit risk 1/4 CLO AAA at ~6% yield, floating rate, 0 duratrion, mark to market risk, infinitesimal credit risk (must see 40% cumulative defaults w/ no recovery in an asset class that typically recovers like 50% of par and whose default rate went to 20% for 1 minute during GFC, ya need like a 4x GFC before the AAA gets touched) 1/4 20 yr BBB at ~6%-7% duration about 12 (0.3% historical default rate) 1/4 20 yr TIPS at ~2% real duration about 12 (duration of TIPS is complex, please accept my oversimplification) this portfolio yields 6% (or more) has almost no credit risk and will go up/down by about 6% for every 1% increase in rates (but will yield more). you could swap in MBS instead of corporates and have less convexity, similar yield, and no credit risk... what are prospective bond buyers waiting for?

-

I buy TIPS in my 401k. there are ETFs as well for both short term and the whole tips market. VTIP owns whole TIPS market so whill have some duration. about 25% of the bond index is mortgage backes so any bond index is investing in MBS which are trading at juicy spreads to tsy's of like 100-200 bps so will yield 5-6.0%, ginnies are explicitly guaranteed and fannie freddie the whole implicit thing...you could also buy VMBS or MBB ETF's to buy those...or AGNC in levered form (I am not doing this). one can buy individual TIPS and tsy's too on fidelity. I don't own TIPS in taxable because you have to pay tax on the inflation adjustment ahead of when you actually get it which for a long term TIP is really unapealling.

-

i find the direction of flows out of the bond market puzzling. TIPS yield 1-2% REAL across the curve. treasuries pay 4% across the curve (which is not out of line w/ long term inflation so are no longer negative real LT rates. Mortgage spreads very wide, can buy a fully government guaranteed 6% or so...which i find attractive whether its a 10 year or 20 year cash flow. IG spreads are decent. I recognize no one wishes to fight the fed, but am still somewhat surprised at the collective cowardice of savers. Man up and buy some bonds, you little bitches. but rates may go up? who cares, all the more reinvestment income on which to gorge. but inflations? if you think inflation is going to continue to roar buy tips. not like stocks are going to do well at sustained 8% inflation...but in that scenario you could lock in 10%/yr at whatever duration you want. but regime change? yes the regime changed. unclear if it will change more. i feel like an island on this and am probably way early per usual (and was early and knew it). this is a long way of saying is i think we may be past the theorretical "natural" rate of interest already and am more concerned about not being able to earn these rates on safe stuff for a while than about rates going up more. but no one...and i mean almost no one...agrees with me on this.

-

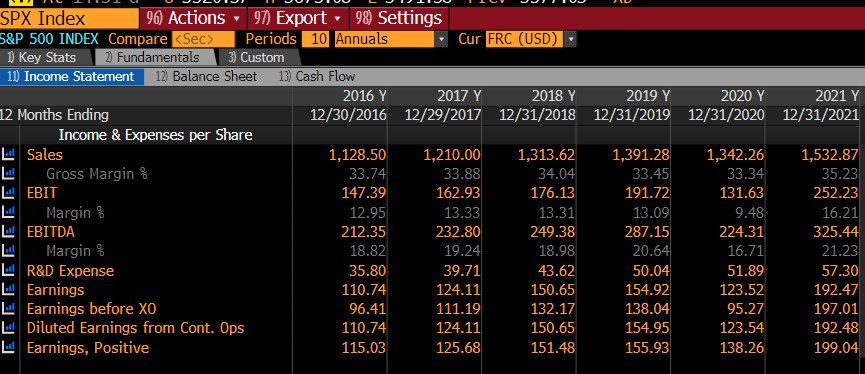

i think most just want to use a more stable basis for comparing various time frames and don't want their lehman writedowns mucking up the P/E on Apple or whatever...it's just one data point. you are free to use whatever metric you prefer.

-

I think rather than assume Aswath is ignorant, the easier explanation is you all are defining things differently. where i work we typically focus on diluted earnings from continuing ops, which declined about 25%, 33% and 20% in the early oughts, 2008, and 2020, respectively. I think most market practitioners would as well given the noise created by writedowns. GAAP purists may protest.

-

BBB 10 yr spreads are currently 230. The average since 2000 is 260. The average for the past 10 years is 240. For perspective covid was ~430 and GFC was 600. December 2018 was about where things are now. It's true. Spreads are not really wide and are pretty much average. I have a much lower return requirment than @Spekulatiusfor bonds. I think if one can get 6-7% with decent duration (10-20 years) from a very healthy company that that has a role in a portfolio. it's just a safe way to build up a mortgage offset and to increase ones recurring cash flow for reinvestment. I do not want to be 100% equities forever, because i don't plan on having enough money to where i'd be comfortable with a really really low withdrawal rate. having a portion of the portfolio that's spitting out cash and not dependent on market for return is nice (and is structurally ahead of equity). I do not think we revisit covid like spreads given that tsy bonds are offering decent yields. IG bonds are at all in yields that solve a lot of asset owner problems. To an insurance company, a 400 spread over 2% 10 yr (covid) is the same nominal return as 200 spread over a 4% 10 yr. Absolute yields matter too. we are at the highest absolute yield on BBB 10 yr debt since September 2009 (6%). 10 yr average is 3.5%. 20 yr average is 4.5% Corporate (and by that I mean large cap IG corporate) credit quality is spectacular. BBB historical default rate is 0.3% and corproates will enter this period with the most interest coverage, longest duration, lowest coupon debt ever. the bonds are all getting chopped to discounts well below par because coupons are so low which provides theoretical downside protection (though i don't think that really matters because virtually none will default). also i think we'll see less creditor unfriendly things like debt funded buybacks in this environment. on the margin companies will deploy incremental capital to deleveraging. a negative for equities, but a posiitve for the owner of healthy corporate debt. I also think there's an argument that why even bother with corporates when you can buy mortgages with no credit risk for similar yields (but less convxity and predictability of cash flows)

-

I don’t think they’re unique. They trade roughly in line with other similar duration/credit paper. It’s just a company I’m comfortable with it’s not uniquely “cheap” or anything. Just spread change + duration in line with mkt.

-

like this bond at 6.5%. Aggregates are a high multiple asset (but cyclical) and MLM owns a bunch of ‘em. $25B EV $5B of debt, 3.5x levered but will be much more levered in a recession as EBITDA will decline but my point is that this is 25% LTV / not going BK absent a depression.

-

Yea I own them, generally good 20 yr credits can be had for 5.6% (Berkshire energy to 6.7% charter)

-

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

also there's some safe floating rate stuff out there that's becoming reasonable alternatives to equities. CLO AAA is now at 5.6% yield. this is for AAA tranche on structured leveraged loans, so for them to lose money you'd need far far worse than GFC type stuff and has no duration. https://twitter.com/thepupil11/status/1570831452807516161?s=20&t=XeAdGxvFeCKZdz2eVPrvBQ -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

I don't really agree with this. The bond market in total has duration of ~6.7 and yields 4.4%. if rates go up by say 3%, it'd lose about 20% (slightly less, but we'll use 20), less the yield along the way, so if it happened over a year you lose 16% (probably a little less). If rates went to 7.5% I'd expect stocks to be down far more than 16% unless risk premiums went negative. for corporates, you're starting to get pretty fat coupons/reinvestment such that you can recoup losses quickly through reinvestment. stocks are perpetual instruments. they're far more vulnerable to increase in the cost of capital than bonds, generally. of course if you're talking a 30 year zero coupon that's a different story. -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

bonds and cash have far lower duration than stocks and outperformed stocks during the last inflationary period. it's not entirely irrational. also TIPS offer positive real yield. I think MANY market participants are looking at bonds and seeing them as a viable alternative (for at least some portion of capital) -

I don’t want to manage OPM until it’s almost completely on my terms. here’s how I invest mine, you will be alongside me, here are the terms, no promises other than alignment. Makes the whole thing a bit of a pipe dream potentially, but don’t think I’d navigate well otherwise. Would rather stay in w2 land if not.

-

it wasn't a lost decade for everything, even very broad indices of other asset classes/geographies would have helped the diversified investor. I think it's important to have diversity of types of ideas/assets etc (if drawdown sensitive). I'm not great at this, have very strong US bias.