thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

you are probably right. I just did what i thought was closes to shorting the stock but with limited risk/capital outlay...really i probably should have just shorted it and bought the call like did recently with ARKK. I trade options with the knowledge that whatever I do, I'm definitely not optimizing or doing it perfectly, so appreciate the feedback and would love any resources that guide your general thinking as to how to approach. My approach has been that of a middle of the curve liberal arts major who should probably put more time into thinking about the precise construction.

-

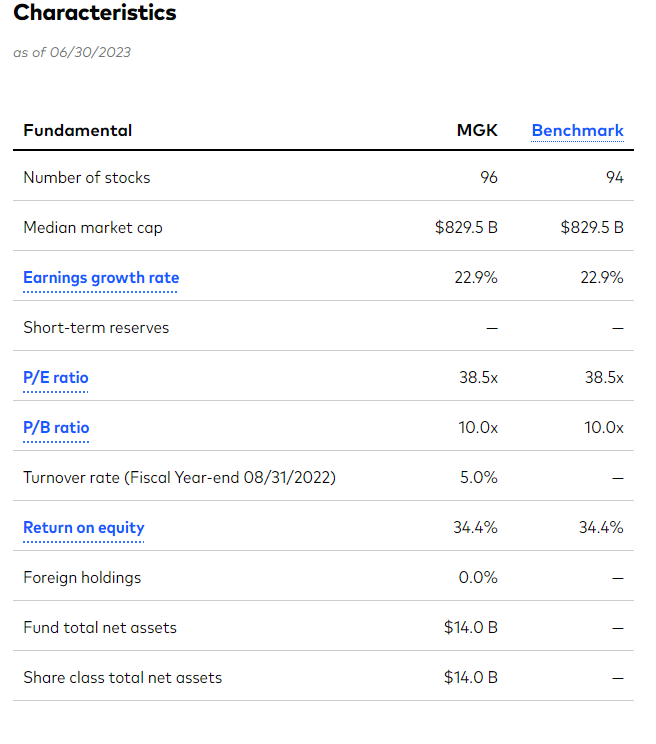

MGK risk reversal. Sell 245 Call, Buy 265 Call, Buy 245 Put. Jan 2024 This gives me about short exposure of 15% MGK and limits my loss to 125 bps pre-tax. I can take the loss in either 2023 or 2024 allowing for flexibility. Probably dumb. Can't resist.

-

goldman's email format is first.last@gs.com and it obviously just means GFY

-

For better and worse, a $500k a home isn’t indicative of an area being expensive anymore. Close to average/median home price in US now.

-

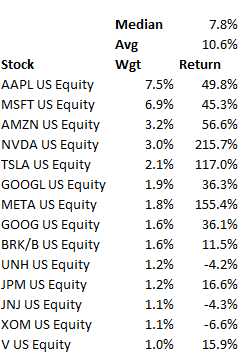

The median and average of S&P 500 stock is up 8% and 11% YTD. For the top 10, those #'s are 48% and 72%. Everyone should be accountable for their performance. Part of the whole point of indexing is to ensure that you capture the big winners in a given year, so narrow contribution to an index's performance does not invalidate those who index (and in fact could be seen as a validation as it illustrates how hard it can be to outperform). with that said, it's probably been one of the more extreme short term periods

-

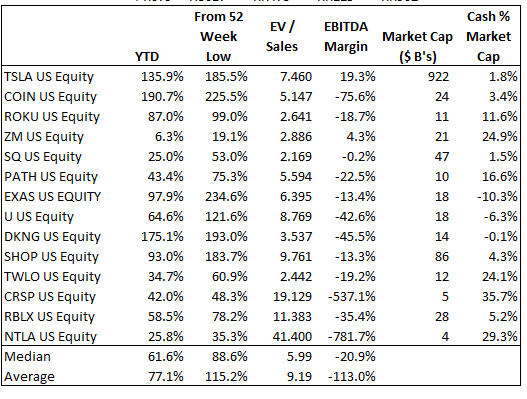

I think it's reasonable time to short ARKK on a speculative basis. Speculative stocks have seen a dramatic bounce from their lows / YTD. I shorted about 6.2% today and purchased Jan 2024 calls limiting my loss to about 26% of the position. Should ARKK go > 60, I'll lose about 160 bps pre-tax.

-

-

So this gregmal guy…is he in the room with us now?

-

why would that be a problem? if anything this would seem healthy for most people given the huge gains experienced 2019 to present, and would not represent an issue for those who bought at the top given they did so with amortizing nominal mortgages and flat prices would allow for an okay exit as long as one doesn't sell first few years due to transaction costs. I mean, my home went up 50% in 3 years. Holding on to that for next 3-10 at flat prices and just amortizing down is kind of my base case...

-

So What Exactly Is The "Short Homebuilders" Thesis At This Point

thepupil replied to Gregmal's topic in General Discussion

I think pretty much everyone would agree with you. I've highlighted the key qualifier. Applying a DCA approach assumes a portfolio to which one is able to add through a downturn and is not utilizing for any purpose other than to build wealth for some far out purpose. Most would agree that on a 15-20+ year time horizon stocks will beat bonds/cash. Using DHI as an example. DHI has returned 12.3% / year for the last 20 years. I just did a quick spreadsheet using last 20 years of monthly total returns. Here's your IRR's at various withdrawal rates (with no upward adjustments for inflation, so monthly distribution is the same. $10K invested 20 years ago WR IRR Ending 0% 12.3% $99K 5% 10.8% $44K 10% 5.2% Depletes in 5/2017 (notice that despite the 20 year return of the asset being greater than the withdrawal rate, the corpus is depleted in year 14, volatility and withdrawals kill the corpus) Now let's reverse it. What if we add money? We add 5% of initial 10k / year 10% and 20% Savings Rate IRR Ending 5% 13% $155K (on $20K total invested, $10K initially then $42/month) 10% 13.4% $210K (on $30K total invested, $10K initially then $84/month) 20% 13.9% $321K (on $50K total invested, $10K initially then $166/month) So it's the same as the point I made elsewhere, one's attitude toward volatility depends on whether or not one is adding to the overall portfolio as well as the correlation between investments. I ran this quickly. I may be wrong. Feel free to check/challenge as you wish. @Gregmal one thing I've always found befuddling about your comments on this subject is you simultaneously espouse high qithdrawal rates ("you don't need that much money to do ________ and 4% rule is dumb") and immunity to volatility. The two ideas in my mind are contradictory and potentially dangerous in combination to all but the most adept of investors (which you likely are) but it would lead to ruin for many others. EDIT/ADD: same with bond index for last 20 years, which has returned 3% / yr WR IRR Ending 0% 3.0% $18K 5% 3.6% $5.7K 10% 4.4% Depletes in 6/2016 (Here the corpus is depleted because bonds by themselves aren't generating adequate return. In both DHI's and bonds' case, you die but for two different reasons. The "safe" bonds don't earn enough. DHI makes enough on a long enough time horizon but is too volatile for a 10% WR). So there's no question here. Investing in DR Horton instead of the bond index was superior 20 years ago. Even at a 10% withdrawal rate. But at a 10% withdrawal rate, DR Horton is only 80 bps of IRR better and depletes 1 year later despite returning much more than bonds. So if you think you can identify stuff that will make 12% / yr for the next 20 years...that will likely beat the snot out of bonds (which are currently priced to return 4.8% ish / yr. But as with everything it a big fat "it depends" Now let's get crazy and assume 70% DHI / 30% bonds, rebalanced at the end of every month WR IRR Ending 0% 11.15% $81K 5% 10.5% $41K <---note this is just 7% less than 100% DHI and distributions are the same. 10% 8.4% $340 <---We are on the verge of depletion, BUT we lasted over 6 years longer than 100% DHI. Notice how by doing 70/30 we didn't reduce overall IRR by that much relative to 100% DHI? And at higher withdrawal rates the addition of the safe asset improved IRR and increased survival. But let's assume again rather than subtracting we're adding, just doing the add 20% with the 70 /30, I get a 12% IRR / ending value of $244K, which is 24% less than the almost 14% / $321K for DHI. So at the risk of obnoxious repetition, whether you like volatility depends on whether you're adding or subtracting to the portfolio. Highest and most volatile CAGR WINS if adding. This is basically MPT which most value investors call bullshit. But it's not really all bullshit. -

I think a lot of you assume that people exclusively work for money. simply not the case. I'm 95% sure I won't have a w-2 at 50 and 70% sure it's gone at 45 and 50/50% at 40. I wouldn't be surprised if my wife worked until 70. lots of reasons people work besides money / consumption (help people, use degree/s, status, fulfillment, etc). next door neighbor's hubby is a surgeon. she's a teacher at a school in bad hood. very hard job. clearly not doing it for the cash. for me, it's a simple exchange of labor for capital. once enough capital is there, I'm not working for someone else.

-

yea the decision is deeply personal and extends well beyond the math. in my circle, almost all the wives work (90%+) and if I had to wager the math probably only makes sense for 25-30% of them if considering it on a near term year to year basis. The math on a long term basis gets more complex. it's not really about the money today so much as it is about career momentum/fulfillment/not wanting to stay home/etc.

-

there are ways to optimize one’s assets and income for this. Generally you weight your assets toward retirement account, primary home equity and avoid income in the years leading up to college, and then apply to FAFSA only (there are schools that use another form). this is not my plan, but I’m aware of the methods. You can google around. Can make sense for someone who has a kid that can get into the top 10-20 schools with generous aid to game the EFC lower. In many cases don’t think makes sense.

-

do you have a family? is the 60K pre or post tax?

-

I think DC market standard probably includes a greater % "on the books". in the interview process it was about 50/50. our nanny is a citizen so she wants the social security/income/etc. my family/friends who live inother parts are shocked we pay "on the books" w/ health insurance, etc.

-

our nanny's total comp and benefits is $60K, so we need to make $100K to pay her. That's a luxurious choice/investment in my wife's career on our part, but day care would be $36K/year / need to make $60K. In NYC, I've heard $80 or even $100K+ is not uncommon and there the marginal tax rate is more like 50% in which cash you could "need" $200K gross to pay for childcare*. *by childcare, I mean the ultraluxurious/extravagant choice to pay someone full time to assist you in watching your children, which may make sense for some people Being short on time (which is what happens in a dual career household) is an incredibly expensive choice.

-

Absolutely! For most high income people, their biggest "expenses" are a) taxes b) savings and c) childcare/education. . The first two decline substantially when ones W-2 goes away. The third could also change drastically if one or two spouses don't work or you do public school. our net takehome is about 58% of gross after taxes and 401k's, health insurance, etc. You can also see this in the percentiles. $2.5mm net worth is 94.5 percentile household net worth, whereas the "equivalent" income is $100K is only 82nd percentile of individual earners. It's much more common to have income than it is to have the assets to endow that income.

-

then you’ll “need” to have much more… this is why I like top 5% ish. It’s broad enough. More realistically achievable . Of course there’s always someone with more $. But I’m talking your everyday rich people in the US.

-

I define rich as top 5% ish. everyone else will define differently. So take a given geography, take a top 5% household income. So in DC that's like $400K, in Mississippi that's like $180K https://dqydj.com/income-percentile-by-state-calculator/ then you tax affect that. So like $400K of W-2 income in DC is after tax ~$240K. and take the assets one would need to generate $240K from investments. $240K*25=$6 million. Rich in DC $6 million. Mississippi = $135K after tax. $135K*25 = $3.4 million. Mississippi Rich is $3.4 million. Maybe adjust down a little as one doesn’t have to save once you have the assets. Maybe decrease by 20% or so, gets you to $2.5-$5mm which feels about right to me, particularly if out of the childcare/school years, then thats just a shit ton of money! Can one lead a wonderful life with less in these places? Of course! But just to try to put some rough numbers on it.

-

for whatever reason, I wasn't able to do this trade at Fidelity. Fidelity didn't allow me to borrow A shares. I didn't try at Interactive Brokers because my parents fidelity account was only one i deemed suitable large for the trade.

-

A nice discussion of rebalancing bonus (relevant to cash/bonds/other non equity stuff) https://portfoliocharts.com/2022/04/12/unexpected-returns-shannons-demon-the-rebalancing-bonus/

-

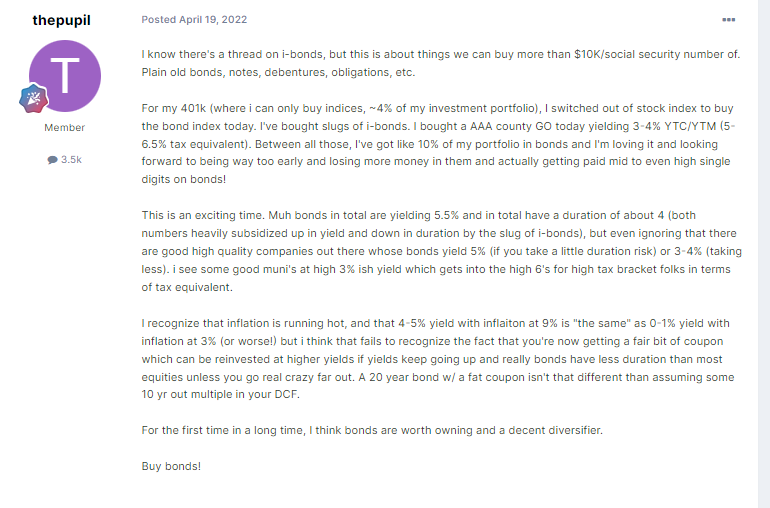

So about a year ago, I started a thread arguing that bonds were starting to look like a real alternative to equities and were beginning to become more relatively attractive to equity indices. By alternative, I do not mean "you should sell all your stocks and buy bonds". By alternative, I meant that holding bondsas part of a diversified investment portfolio would cost less in opportunity cost than in the past because yields were perking up and becoming more competitive with yields on stocks. If you think stock indices will do 6-8% / year for 10 years or whatever, whether bonds yield 0%, 2%, or 4% determines the opportunity cost of holding bonds. an aside: I think I'm an outlier amongst folks here and probably my peers, but I think that the traditional 60/40 or 70/30 portfolio works well in growing and preserving purchasing power and is a reasonable approach; VWENX can work just fine for a lot of people (a relatively smooth 8.2%/yr since 1929 as the world's oldest balanced fund). Financial repression and ZIRP though forced people to either buy bonds are really really low yields or take on more risk to earn the same return and I view the reversal of that as a positive. TIPS offer real yields. bonds pay a withdrawal rate and arguably have less opportunity cost.I think Powell is mostly doing a good thing by returning to a normal cost of capital. there will be some adjustment, he may go too far, some shit may blow up, but I don't think we should be at ZIRP forever. back to bonds/stock: Since that thread, bonds have made about 0% in total return. Stocks are down 5-6%. The market PE (using S&P 500/trailing PE on bloomberg) has de-rated from 21x to 18x, margins have come down and the index composition has changed such that EV/Sales has gone from 3.1x to 2.6x. On a very short term, 1 year basis, I'd say the idea of bonds becoming "reasonable" as part of a portfolio was correct. I personally went from 0% to like 25% ish in bonds/cash/CLO AAA etc, but am now more like 85%/15% as found some opportunities. Looking at today, I still maintain it's not entirely crazy to have some bonds. What's interesting is that the nominal yield on S&P 500 was about 4.7% 1 year ago and is now 5.5% (so it increased by about 80 bps), but bonds also increased in yield from 3.2% to 4.4% YTW on Barclays agg index. So both asset classes saw a de-rating, it's just that reinvestment of coupon and lower duration is the reason that bonds OP'd stocks. that's what i like about bonds, in a rising rate/rising cost of capital environment you don't really lose much and aren't takin on general economic risks. the reinvestment of safe coupon keeps you in the game. I hope rates continue to rise (though I don't think they really can). I love having safe bonds/cash/whatever as a tool in the toolkit. stocks will (hopefully) destroy bonds over next 10-30 years, but nothing wrong with having some diversifitcation / other ways to preserve and grow purchasing power. @Gregmalwill say the indices don't matter. For many they do. they matter in terms of how I deploy $60K/yr where indices are my only option.

-

Berkshire has issued stock for a few acquisitions, Dexter Shoe (the dramatically named biggest mistake) and BNSF. I suspect the trust owned a BNSF predecessor which became Berkshire Hathaway stock.

-

I agree with you IF and WHEN NOI goes up, but if each building keeps performing as they did last year/Q and rates are at current or higher levels in ‘27/‘28, that seems pretty ugly to me. The debt yields are siny too low, I’d like every building to be at say 7-8% (7% = 78% LTV at a 5.5% cap rate, so I’m not talking blue chip REIT pansy leverage) I frankly hadn’t looked at it in a while and failed to appreciate the degree to which almost every building (except their offices) had such low NOI relative to gross cost and relative to debt. because of their fragility and inability to retain earnings, REITs should only return more capital than necessary from a position of unquestioned strength. A lot of people hated on Roth in 2019/20 for not buying back stock like SLG…I imagine SLG would like its $3B back. retaining capital in the face of potential stress is the right move.

-

We’ll have to agree to disagree here. I think a buyback is potentially value destructive given the balance sheet. If I was running the company, I’d want to be sure every building is in a Good place first, may even make snes to cut the divvy. looking at the situation, if I was I. Charge I’d cut divvy to $0 with a pledge to pay out taxable income for REIT tax compliance. Buyback would in no way be in the cards for me.